Medicare cost in 2021 are on the rise. These changes, are not significantly higher, but do outpace the Social Security cost-of-living adjustment and effect many seniors who are on a fixed income. The Centers for Medicare and Medicaid services (CMS), officially released news in November 2020 of the new Medicare cost 2021 changes. Medicare Part A and Medicare Part B cost will be increasing, as will certain components of Medicare Part D. Medicare Advantage plans will see average cost being lowered, and additional benefits added.

So how much will Medicare cost in 2021?

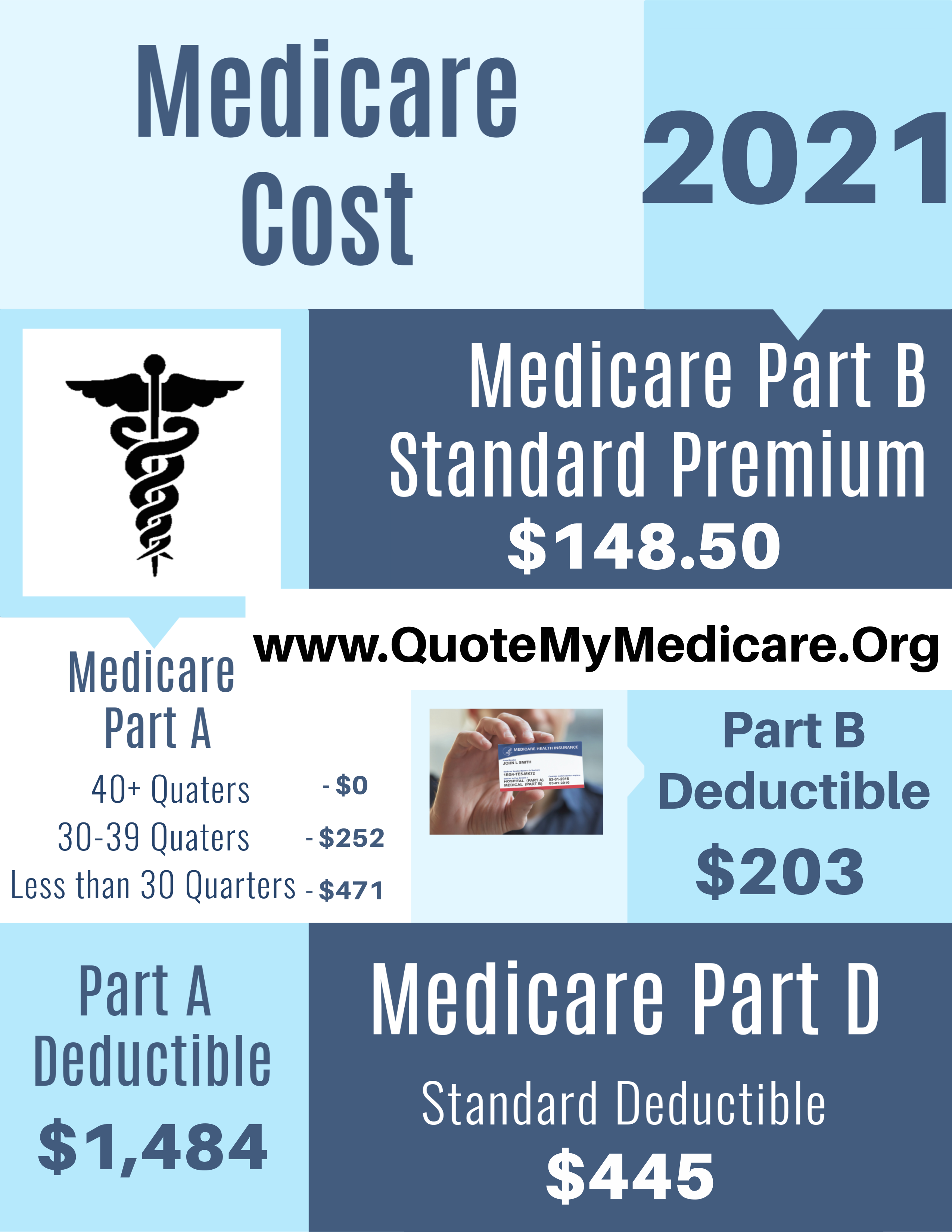

Medicare Part A Premiums and Deductibles | Medicare Increase 2021

Most people in America do not pay a premium for Medicare Part A since they have worked and paid taxes into Medicare over their lives. Other Medicare Part A cost include deductibles and some coinsurance on certain services. For seniors in America who do not have a Medicare supplement or Medicare advantage plan, these Part A cost can add up.

Most people in America do not pay a premium for Medicare Part A since they have worked and paid taxes into Medicare over their lives. Other Medicare Part A cost include deductibles and some coinsurance on certain services. For seniors in America who do not have a Medicare supplement or Medicare advantage plan, these Part A cost can add up.

The Medicare Part A deductible 2021 will be $1,484, which is a $76 increase from the 2020 Part A deductible of $1,408. Several other Part A related cost are also increasing. The daily coinsurance four days 61 through 90 in the hospital are going from $3352 in 2020 up to $371 in 2021. The daily coinsurance for lifetime reserve days in the hospital is also rising from 704 in 2020 up to $742 in 2021. The skilled nursing facility coinsurance under Medicare Part A was $176 in 2020 and will rise to $185.50 in 2021.

For people who have not worked 40 quarters during their lifetime, but have worked at least a minimum of 30 quarters, their Medicare Part A premium will be $259 per month. For those who have worked less than 30 quarters, the full premium for Medicare Part A will be $471 a month in 2021.

Keep in mind most Americans have Medicare supplements or Medicare advantage that cover many of these coinsurance and co-pay out-of-pocket cost. Also, most Americans will NOT pay a premium for their Part A, or a Medicare deductible in 2021 for Part A (who have supplemental coverage) .

2021 Medicare Part B Premiums and Deductibles

Unfortunately, for a third year in a row we are seeing the Medicare Part B premium and deductible increase. The standard Medicare Part B premium 2021 will be $1148.50, which is an from the $144.60 Part B premium in 2020. The Medicare Part B deductible 2021 for beneficiaries is rising to $203, which is an increase from the annual deductible of $198 in 2020.

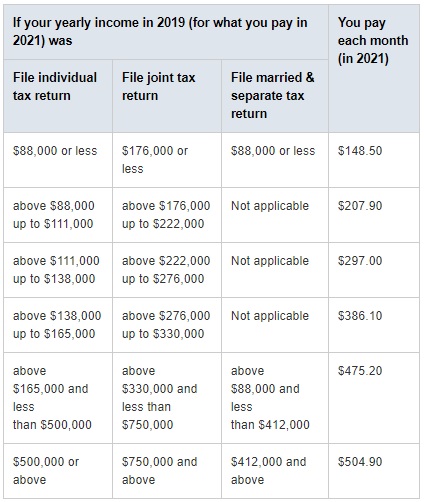

For individuals who earn over a certain amount the 2021 Medicare premiums are actually even more expensive. IRMAA stands for income related monthly adjustment amount, and effects roughly 7% of Americans regarding their Medicare Part B premium.

The table below shows what the IRMAA premiums are for 2021. Beneficiaries who file an individual tax return above $88,000, or a joint tax return over $176,000 are subject to a higher 2021 Part B premium. These individuals however are charged the same 2021 Medicare Part B deductible, as those who are at the standard income rate.

Medicare Part D Prescription Drug Changes for 2021

In 2021 if you enter the coverage gap, you’ll pay no more than 25% of the price for the brand-name drug, and almost the full price of the drug will count as out-of-pocket costs to help you get out of the coverage gap.

The standard Part D deductible will increase to $445 in 2021, which is up from the standard deductible of $435 in 2020. Unfortunately one of the largest increases seen regarding Medicare Part D is the catastrophic coverage threshold. In 2021 there will be a $200 jump from $6,350 in 2020 up to $6,550 in 2021.

In the event a person pays $6,550 in out-of-pocket cost, they would enter into the other side of the donut known as catastrophic coverage. Here, prescription drug cost for beneficiaries drop significantly for the remainder of the year. Many seniors who hit the donut, typically do so at the end of the year, and never hit this phase.

As for the Medicare Part D late enrollment penalty, we do not yet know what that will be in 2021. There should be more information released at the first of the year by CMS regarding what it will be.

Medicare Supplement Changes for 2021

First dollar coverage plans where eliminated in 2020 for those who become eligible for Medicare after January 1st 2020. Those plans include Medicare Supplement Plan C, Medicare Supplement High Deductible Plan F, and the very popular Medicare Supplement Plan F. This is no surprise as the Medicare access and chip re-authorization act of 2015 stated this would take place in 2020.

Those Medicare individuals who are already on one of the three plans mentioned will be allowed to keep their plan and potentially shop for other like plans as well. These beneficiaries will not be effected by the 2020 Medicare Supplement changes.

Medicare Supplement Plan G and Medicare Supplement Plan N will be the two most popular plans in 2021. Depending on what state you reside in, there are several companies that have vary competitive rates for Plan G and Plan N. AARP Medicare Supplement Plans and Aetna Medicare Supplement Plans are looking competitive in 2021.

2021 Medicare Advantage Plans

In addition to dental, fitness, vision, and hearing benefits, many Medicare Advantage plans in 2021 will be offering limited personal supports and services. These benefits will not substitute for Long-Term Care, however they will make it easier for many seniors, who have chronic or severe conditions, to stay in their own homes. According to CMS, “on average, Medicare Advantage premiums in 2021 are expected to decline 23 percent from 2018.” CMS projects that around 24 million people will enroll into Medicare Advantage plans in 2021. So far, about a third of Medicare beneficiaries are in Medicare Advantage plans already. There are currently around 3,200 Medicare Advantage plans across the United States. Medicare Advantage Special Needs Plans (SNPs) are on the rise across the US as well. The will be an expected 855 SNPs available in 2021.

Social Security cost of living adjustment for 2021

Will Social Security Benefits go up in 2021?

Over 68 million Americans will see an increase of of their Social Security and supplemental security income in 2021. While this is a positive thing, many seniors are frustrated and upset at the fact that their Medicare premiums and deductibles continue to rise eating up this cost-of-living adjustment.

What’s your take on the matter? Should the Social Security adjustment be higher than the increases in Medicare cost each year? Leave us your comment below and tell us your thoughts.

Speak with an experienced advisor!

Speak with an experienced advisor!