A Complete Medicare Part B Overview

The Medicare program in its entirety is composed of several different parts. When you’re looking for healthcare coverage, learning about these individual parts and knowing your choices in detail can be a significant help. Part A of the Medicare Program is an insurance plan for hospital coverage. It also includes some domestic health services, hospice care, and skilled nursing care for an individual that is returning home after having stayed in the hospital. Now, let’s better understand the second part, Medicare Part B.

What is Medicare Part B?

Part B of the Medicare Program is an insurance plan that helps you get coverage for medically necessary supplies and services, for treating or diagnosing a health condition. Medicare Part B includes outpatient medical care received at a hospital, clinic, doctor’s office or any other healthcare facility. That means that Medicare Part B is often highly necessary for complete coverage for an individual.

The insurance plan also helps an individual get coverage for preventive services such as yearly checkups. This is important for preventing diseases and detecting health issues at the beginning, when the condition is still in its initial stage. Medicare Part A and Medicare Part B are together called Original Medicare. Anyone who qualifies for Medicare Part A is qualified for Medicare Part B. The difference between Part A and Part B of Medicare is what they one focuses on hospital coverage (part A), while the other focuses on medical coverage (part B).

Medicare coverage is influenced by the following three factors:

• Federal and state laws relating to healthcare insurance.

• Decisions relating to national coverage made by Medicare.

• Decisions relating to local coverage made by insurance companies in each state that process Medicare claims. These companies determine what is medically necessary and how much coverage should be given for these needs. Some of the preventive services covered by Medicare Part B include a one-time physical examination, hepatitis B and flu shots, cancer screenings, diabetes screenings, cardiovascular screenings, and much more.

Medicare Part B Coverage

The following are a few aspects covered by Medicare Part B:

• Physical examinations

• Laboratory tests and screenings

• Glaucoma screening once a year by an authorized doctor

• Bi-annual bone mass measurement for people with high chances of getting osteoporosis

• Diabetes screenings for people with dyslipidemia, high blood pressure, high blood sugar, and obesity

• Diabetic supplies, such as therapeutic shoes, test strips, lancet devices, and monitors

• Self-management training for diabetics who are at a risk of developing health complications

• Colorectal cancer screening to detect malignant growths at an early stage

• Cardiovascular screenings for preventing strokes and heart attacks

• Clinical research

• Durable medical equipment

• Ambulance services

• In-patient and outpatient care

• Partial hospitalization

• Preventive shots

Additional medically necessary and preventative health services may be included in the coverage:

• Diagnostic hearing and balance examinations

• Dialysis

• Mammograms

• Pelvic examination, pap tests, and breast examination

• Medical nutrition therapy

• Occupational therapy

• Prosthetic devices

• Physical therapy

• Organ transplant services

• Services from a nurse practitioner

What Medicare Part B DOES NOT cover

Medicare Part B doesn’t provide coverage for all health-related expenses. The following are a few items excluded from its coverage:

• Dental care and dentures

• Long-term custodial care

• Cosmetic surgery

• Eye examinations where glasses are prescribed by the doctor

• Hearing aids and other examinations.

• Acupuncture

• Routine foot examinations.

• Wellness or fitness programs

How much does Medicare Part B cost?

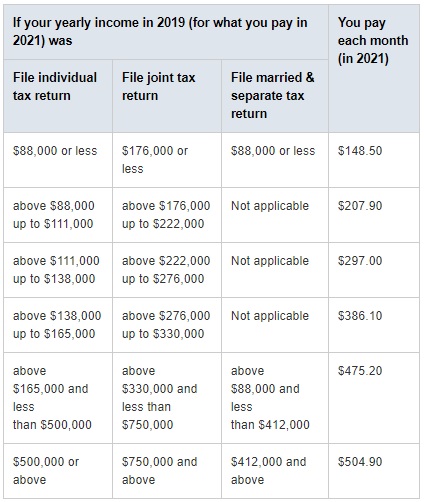

Medicare Part B requires you to pay a monthly premium. Most people pay a standard amount as their premium, unless their gross income exceeds a certain amount, which makes them eligible to pay an Income Related Monthly Adjustment Amount (IRMAA). Let’s look at 2021 Medicare Part B cost.

The standard premium amount for Medicare Part B is $148.50, which may increase depending on your gross income.

Some individuals may not have to pay the full Part B premium, or even get their part B at no cost based on getting extra help, or a low income subsidy.

The standard premium payment is payable if:

• 1 – You are enrolling in the plan for the first time in 2021

• 2 – You don’t currently get Social Security benefits or any other benefits from the Railroad Retirement Board.

• 3 – Your gross income return from two years exceeds a certain amount.

What are the Medicare income limits for 2021?

Medicare Part B does have a significant deductible as well, costing $203 each year.

This amount is applied to most healthcare costs covered under Medicare. Some of these costs include outpatient hospital services, physician services, medical equipment costs, and home healthcare services.

Once you meet your deductible limit, you are required to pay 20 percent of the Medicare-approved amount as coinsurance. This includes most doctor services, outpatient therapy and medical equipment. It may be noted that preventive services, which are provided for free, do not require you to meet your deductible. Also, there may be exceptions to the limits on occupational therapy, physical therapy, and speech-language pathology services.

Once you meet your deductible limit, you are required to pay 20 percent of the Medicare-approved amount as coinsurance. This includes most doctor services, outpatient therapy and medical equipment. It may be noted that preventive services, which are provided for free, do not require you to meet your deductible. Also, there may be exceptions to the limits on occupational therapy, physical therapy, and speech-language pathology services.

Keep in mind, Medicare Part B costs change year-to-year and gross income brackets continuously change as well. For instance, in 2017 you only paid the highest premium amount ($428.60) if you made over $214,000. However, in 2021 you pay the highest premium amount if you make over $500,000. It’s important to know the current rates and income bracket that you’re placed in for the given year.

Who is eligible to get a Medicare Part B insurance?

If a person is eligible for a Medicare Part A premium-free insurance plan, they can apply for a Medicare Part B.

You can qualify for a Medicare Part B plan even if you are not eligible for a Medicare Part A plan if you fulfill the following criteria:

• You are at least 65 years old.

• You are a citizen of the United States or a permanent resident residing in the country continuously for no less than five years.

You may become eligible for Medicare Part B automatically with a physical disability. If your age is less than 65 years old and you are getting Social Security or Railroad Retirement Board disability benefits, you get enrolled automatically for Medicare Part A and the Medicare Part B insurance plan after twenty-four months of receiving your benefits. You may also be eligible for the insurance plan before the age of 65 if you are diagnosed with end-stage amyotrophic lateral sclerosis or renal disease. Anyone who is eligible for Medicare Part A and B may also have the option of enrolling into a Medicare Advantage or Medigap plan.

When to enroll for a Medicare Part B plan?

You have to enroll for Medicare Part B during your Initial Enrollment Period (IEP), unless you are eligible through disability or getting benefits before the age of 65. The Initial Enrollment Period is a seven-month period starting from three months before you become 65; it includes your birth month and ends after three months. The start date of your Medicare coverage depends on the month you enrolled. In case you are not able to enroll during your IEP, you can do so between January 1 and March 30, which is the General Enrollment Period.

When you are 65 and have a Medicare Part B plan, your Medigap Open Enrollment period begins. This six-month period is best for buying a Medicare Supplement Medigap plan because you get “guaranteed-issue right” to buy a plan without paying a higher premium or requiring medical underwriting services. Once you sign up for Medicare Part B, make sure you don’t miss this period for applying for a Medigap plan.

How to enroll for a Medicare Part B plan?

Medicare is under the management of the Centers for Medicare and Medicaid Services (CMS).

Social Security works closely with the CMS by helping individuals to enroll in Medicare. You have the option of applying for a Medicare Part B plan online at the Social Security website. It takes less than 10 minutes for them to process your application. You can also choose to visit your local Social Security office or call them at 1-800-772-1213 for more information. The best part is – you don’t have to fill out forms or submit documents. Social Security will process your application and send you your Medicare card through the mail. If you have worked for a railroad, you can call the Railroad Retirement Board at 1-877-772-5772.

Speak with an experienced advisor!

Speak with an experienced advisor!