Medicare Explained Simply

While most people count on Medicare for their health care coverage at age 65 and over, the reality is that this program can be somewhat confusing in terms of what is – and isn’t covered – and under which “part” of Medicare different items and services fall.

A recent study by Fidelity revealed that retirees’ health care costs have continued to rise over time. That isn’t too surprising. But what is alarming is that the study also showed that a 65-year-old couple will, on average, spend $295,000 on just their health care needs throughout retirement – and this doesn’t include long-term care expenses. 1

Here, for instance, just some of the out-of-pocket health care related costs that retirees typically face are the copayments, coinsurance, and deductibles that are related to Medicare coverage. So, it is important that you know what you can anticipate regarding Medicare’s benefits, and that you have a viable plan in place to cover some or all of the costs that you may be responsible for.

What is Medicare and What Does It Cover?

Original Medicare is coverage managed by the federal government. The first step in helping to reduce your health care costs is to know what is covered for each “part” of Medicare. When the Medicare program began in 1965, it consisted only of Part A (for hospitalization coverage) and Part B (for doctors’ services). This is why even today, Medicare Part A and Part B is referred to as “Original Medicare.”

How Does Medicare Work?

Medicare is broken down into several parts. Each part of Medicare covers a specific area. Though it gives protection for many basic healthcare cost, it does not cover everything. The Centers for Medicare and Medicaid Services (CMS) manages Medicare, while Social Security offices are responsible for facilitating enrollment. Throughout the years, the Medicare program has expanded, and today there are four parts to Medicare’s health care coverage. These include:

- Part A – Hospitalization

- Part B – Medical and Doctors’ Services

- Part C – Medicare Advantage

- Part D – Prescription Drug Coverage

Medicare Part A – Hospitalization Coverage

Medicare Part A covers a variety of in-patient hospitalization services, as well as some skilled nursing facility and home health care services. In addition, this part of Medicare may also provide coverage for hospice care.

For most people, Medicare Part A is premium-free, provided that you:

- Are already receiving either Social Security or Railroad Retirement benefits

- Are eligible for Social Security or Railroad Retirement benefits, but you have not yet filed for them

- You or your spouse had Medicare-covered government employment. 2

If you don’t meet any of the above criteria for receiving premium-free Medicare Part A, you may still be able to purchase this coverage. In 2021, the amount of the monthly premium ranges from $259 to $471 per month, depending on how many Medicare work credits you have on your record. 3

Those who are enrolled in Medicare Part A will be required to pay certain out-of-pocket expenses, based on health care services that are received. For example, the deductible in 2021 for each Part A benefit period is $1,484. This amount will need to be paid for each benefit period in which you receive hospital care, before your Medicare Part A benefits will start paying out.

Those who are enrolled in Medicare Part A will be required to pay certain out-of-pocket expenses, based on health care services that are received. For example, the deductible in 2021 for each Part A benefit period is $1,484. This amount will need to be paid for each benefit period in which you receive hospital care, before your Medicare Part A benefits will start paying out.

You may also be responsible for a daily coinsurance amount for hospital care. For the first 60 days of each benefit period there is no coinsurance requirement. However, should you remain in the hospital for a longer period of time, your coinsurance charges would be (in 2021):

- Days 61 through 90: $371 per day

- Days 91 and Beyond: $704 per day

Medicare Part A also includes “lifetime reserve days.” These are days that Medicare will pay for your hospital care when you have been in the hospital for longer than 90 days in a given period. During your lifetime, you have a total of 60 lifetime reserve days. Once these days have been used up, however, they cannot be renewed.

If you have been in the hospital for longer than 90 days, and you have used up all of your lifetime reserve days, you will then be responsible for all of your hospital costs going forward in that benefit period. 4

Medicare Part B – Medical and Doctors’ Services Coverage

Medicare Part B provides coverage for doctors’ services and various other non-inpatient hospital related costs, such as services and / or supplies that are needed for diagnosing or treating certain medical conditions, and various preventive health care services that can help with either detecting or preventing certain issues (such as the flu).

There is a monthly premium required for Medicare Part B. For most people, this premium is $1148.50 (in 2020). However, there are some Medicare enrollees whose income and tax filing status could require them to pay a higher premium for Part B.

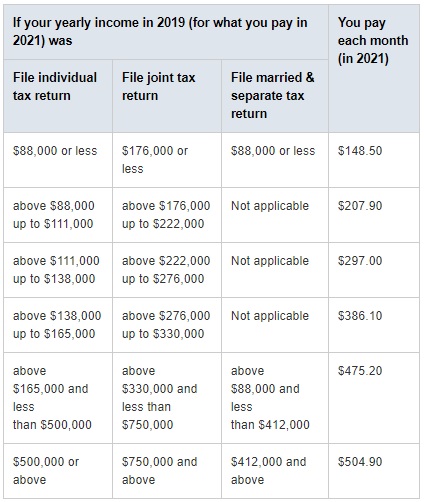

For example, based on your 2019 annual income, you would be required to pay the following amount of monthly premium for your Medicare Part B coverage in 2021:

Source

Source

There is also an annual deductible for your Medicare Part B services. In 2021, this deductible is $203. Once you have met this deductible, you will typically pay 20% of the Medicare-approved amount for most doctors’ services, as well as for other health care services such as outpatient therapy, and durable medical equipment that is deemed to be necessary by a doctor. 5

Medicare Part C – Medicare Advantage

Medicare Part C is known as Medicare Advantage. This part of Medicare is actually an alternate way of receiving your Medicare Part A and Part B benefits. Unlike Medicare Part A and B, Medicare Advantage plans are not offered through Medicare itself, but rather by private insurance companies.

For the most part, Medicare Advantage plans must offer all of the same benefits that are included in Medicare Part A and Part B. However, Medicare Advantage plans may also offer additional benefits that are not included in Part A or B of Medicare, such as vision and hearing coverage, and / or wellness benefits. Many Medicare Advantage plans will also include Medicare Part D prescription drug coverage.

Oftentimes, Medicare Advantage plans are set up in a similar fashion to HMOs (Health Maintenance Organizations) or PPOs (Preferred Provider Organizations), where it may be necessary to choose where you receive your coverage within a network of providers.

The cost of Medicare Advantage coverage can vary. For example, even if you choose to receive your Medicare coverage through an Advantage plan, you will still need to pay your Medicare Part B premium amount. There may also be an additional premium that is charged for the specific Medicare Advantage plan that you choose.

Medicare Part D – Prescription Drug Coverage

Medicare Part D covers prescription medication. If you are enrolled in Original Medicare (Part A and Part B), and you also want to have coverage for your prescriptions, then you will need to enroll in a Part D plan.

Similar to with Medicare Advantage, Medicare Part D plans are not offered through Medicare directly, but rather via private insurance carriers. Therefore, there are many different Medicare Part D plans to choose from – all with differing premium costs.

Also, each of the Medicare Part D plans will have its own list of drugs that are covered. This list is called a formulary. Many of the prescription drug plans will place their covered medications into different “tiers” on their formularies – and in turn, the drugs that are in each of these tiers will have a different cost. It is important to have a good understanding of which drugs are covered in the Medicare Part D plan you go with.

How and When to Enroll in Medicare

So, what makes you eligible for Medicare? Well, how and when to enroll in Medicare will depend upon your work history, as well as whether or not you are already receiving your Social Security retirement benefit. For example, if you are receiving Social Security or Railroad Retirement benefits when you turn age 65, you will automatically be enrolled in Medicare Part A.

You could also be enrolled in Medicare Part B at that time if you sign up. (If you are still receiving other health care insurance benefits at that time, however, you could opt out of Medicare Part B, and enroll in this program at a later date).

If you’re not receiving health insurance benefits from an employer (or your spouse’s employer), or from an individual health insurance plan at that time, then you could be liable for a Medicare Part B late enrollment penalty if you do not apply during your initial enrollment period. Understanding Medicare enrollment periods is important. With this in mind, be sure that you talk with a Medicare expert who can guide you through the process of enrolling in this coverage.

There are several ways that you can go about enrolling in Medicare. If you choose to go with Original Medicare coverage (Medicare Part A and Part B), you can enroll online by visiting the Social Security website at www.SocialSecurity.gov. You could alternatively opt to visit your local Social Security office, or call the Social Security Administration directly at (800) 772-1213.

If you opt to instead go with a Medicare Advantage plan, you should first talk with a Medicare Advantage specialist in order to determine which of these plans is right for you. Likewise, if you choose to add Medicare Supplement insurance to your Medicare Part A and B coverage, talking with a Medigap professional is also recommended.

Filling in Original Medicare Gaps with Medicare Supplement Insurance

Because there are many “gaps” in Medicare Part A and B coverage, such as deductibles, copayments, and / or coinsurance costs, enrollees can find themselves with a great deal of out-of-pocket expenses. In order to help with paying these costs, it can be advantageous to have a Medicare Supplement insurance plan.

Medicare Supplement insurance is a type of coverage that is designed specifically for covering various costs that are not covered by Medicare Part A and Part B, such as deductibles, copayments, and / or coinsurance amounts.

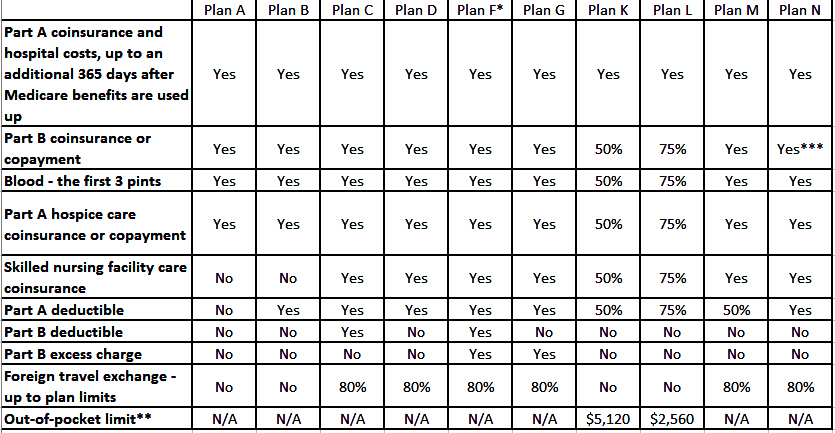

There are currently ten different Medicare Supplement insurance plans to choose from. Which of these Medicare plans is right for you will typically depend on the type and amount of health care services that you anticipate using in a given year, as well as the amount that you have budgeted for this coverage. Below is a Medicare plans comparison chart. If you were not on Medicare prior to January 1st, 2020 plan F and C are no longer offered.

Source: Medicare.gov

Source: Medicare.gov

**After you have met your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 10 percent of covered services for the remainder of the calendar year.

***Plan N pays 100 percent of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that do not result in inpatient admission.

Similar to with Medicare Advantage and Medicare Part D, Medicare Supplement insurance is offered through private insurance carriers that have been approved by Medicare to sell them. Therefore, while the benefits that are offered in each plan of the same letter must be identical, the premium price can differ from one insurance to another – even for the very same plan and coverage options.

It is important that you enroll in a Medicare Supplement insurance during your initial enrollment period for this type of coverage. That is because, regardless of your health condition at that time, you cannot be turned down for a plan, nor can you even be charged a higher amount of premium.

If, however, you wait until your initial enrollment period for Medigap has elapsed, you will not have these coverage guarantees. Your Medigap initial enrollment period starts on the first day of the month in which you are age 65 or older and you are also enrolled in Medicare Part B. Your initial enrollment period for Medicare Supplement then runs for six months after that.

Taking the Next Step to Securing Your Medicare Benefits

Medicare can provide you with a variety of options when it comes to health care coverage. But with the many different parts, along with supplemental coverage alternatives, this program can be somewhat confusing.

So, before you make a commitment on any plan option, it can be beneficial – and oftentimes cost effective – to discuss your choices with a expert. And with over a decade of experience in the Medicare field, we can help you make sense of this program, and to determine which plan may be the best for you, while explaining Medicare simply.

To speak with one of our experts, schedule a virtual appointment or, if you would simply like a quote on Medicare Supplement insurance coverage in order to decide which of these plans may best fit with your coverage needs, and your budget, visit our Quote Page.

Don’t get overwhelmed trying to piece together your health care coverage with Medicare. Contact Us today.

Speak with an experienced advisor!

Speak with an experienced advisor!